Bright (often referred to as Bright Money) is a financial management app with an emphasis on helping you pay down your credit card debt, improve your credit score and build savings.

In the realm of personal finance in 2024, battling credit card debt will pose a formidable challenge for countless American consumers. The numbers paint a clear picture – balances are skyrocketing, crossing the staggering $1 trillion mark, with average interest rates all crossing the 20% mark.

For those struggling to pay off credit card dues, Bright Money boldly presents itself as the ultimate solution. According to their claims, this app is a unique need. Our in-depth Bright Money review sheds light on the intricacies of the company’s offerings, which include loans, credit-building features, and debt tracking tools. Its purpose is to highlight how these resources can be a beacon of hope for freeing yourself from the clutches of high-interest credit card debt, or conversely, how they can inadvertently aggravate an already precarious financial situation. Are.

What is Bright Money?

Bright Money stands as a beacon in the field of financial technology, offering a dynamic mobile app dedicated to helping consumers find debt relief while increasing their credit scores.

The platform showcases its power through three distinctive products, each of which has been carefully crafted to propel users toward financial freedom:

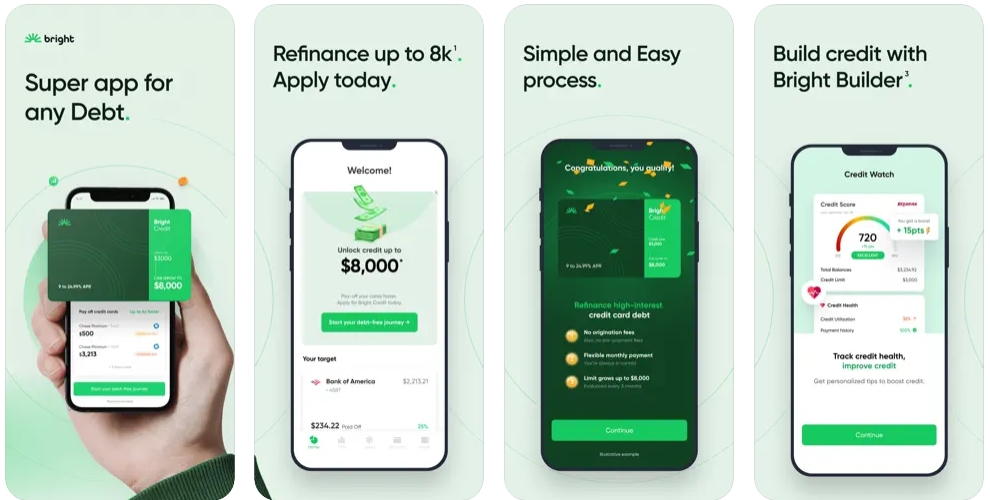

- Bright Plan: This key tool serves as a compass guiding you through your current financial landscape and aspirations. It goes beyond mere analysis, providing tailored recommendations for the fastest and most effective path to your financial goals. Picture this: a personalized, automated spending plan carefully crafted to accelerate your journey to debt freedom while building a strong emergency fund.

- Bright Builder: Enter the realm of secured credit with Bright Builder, a financial instrument similar to a credit builder loan. To unlock its potential, a security deposit is your key, granting access to a credit line matching the deposit amount. Here’s the genius: Each withdrawal is turned into a monthly installment, meticulously reported by Bright Money to the two major credit bureaus. It’s not just a credit builder; This is a step towards a stronger financial foundation.

- Bright Credit: Picture a swirling line of credit adorned with a nominal interest rate. Its mission? To empower you to conquer your heaviest credit card debt. No security deposit is required, making it a symbol of financial freedom. However, keep in mind that a rigorous credit check is part of the application process. Although this is not the preferred option for those seeking a cash advance with a poor credit history, it stands as a strategic move to reduce interest charges and gain control.

In the complex tapestry of financial solutions, Bright Money not only paves the way to financial well-being but also ensures that your journey is marked by professional guidance, strategic planning and a commitment to your long-term prosperity.

How Does Bright Money Work?

Explore the functionality of Bright Money’s offerings by taking a deeper dive into the seamless process of signing up and using these financial products.

Unravel the complexities of Bright Money’s product suite through the simple steps involved in registration and effective use.

Bright Plan

To enroll in Bright Money Review, visit the company’s official website or download the mobile app from the App Store or Google Play. You will be asked to verify your phone number and set up an account using your email and password.

Next, you will need to go through an identity verification process. This includes providing your Social Security number, submitting images of your government-issued ID, and a copy of a utility bill or bank statement showing your local address.

Finally, Bright will request verification of your income and connection of your bank account and credit card. The platform analyzes this information to gain insight into your personal finances, and creates a personalized Bright plan for you.

Using its patented system, MoneyScience, Bright Plan uses the capabilities of data science and artificial intelligence to recommend optimal strategies for paying off your credit cards and achieving your savings objectives.

Primarily, the Bright Plan often suggests employing the debt avalanche strategy, a straightforward approach that involves paying off your highest-interest debt first to reduce interest charges. After this, it generally guides you in building an emergency fund.

A notable feature of the Bright plan is the ability to facilitate automatic transfers from your external bank account to your Bright Stash, a checking account provided by Bright to streamline plan management for you.

Thankfully, you retain the flexibility to withdraw from this account when needed. Additionally, you have the option to manually customize the specifications of your Bright plan, adjusting parameters such as transfer frequency and the amount allocated to your Stash.

Bright Builder

Discover a revolutionary approach to building credit with Bright Money, a dynamic revolving credit line that asks for a minimum security deposit, starting at just $50. You have the flexibility to fund this deposit in a lump sum or through a convenient series of monthly payments. Regardless of the method chosen, access to your credit line becomes possible only after reaching the $50 limit.

Once this milestone is achieved, you have the freedom to withdraw funds up to your available credit limit at any time, initially reflecting your security deposit. However, Bright recommends maintaining a low balance, since credit usage is reported to the credit bureaus.

Apart from reporting your credit utilization, Bright ensures that your monthly payments towards the account are also duly reported. These payments, which make up a minimum of $10 or 50% of your balance, contribute significantly to building your payment history – a paramount factor influencing your credit score.

One of the standout features of Bright Money is its accessibility, as the application requires no credit check. This makes it a viable option even for individuals with less than ideal credit scores. However, it’s important to note that Bright Money shares its data exclusively with Equifax and TransUnion, excluding Experian, which puts some limitations on its overall effectiveness.

Start your credit-building journey with Bright Money – where innovation meets financial empowerment.

Bright Credit

Bright Credit offers a flexible, unsecured line of credit designed to refinance and consolidate high-interest debt, effectively reducing overall financing costs. To qualify for this financial solution, a reasonable FICO credit score is generally required, which usually starts around 580.

If your credit score falls below this range, there is still hope. Although not guaranteed, individuals with bad credit can potentially secure an account with Bright. The evaluation goes beyond raw credit scores, taking into account factors such as credit utilization and outstanding balances.

In addition to traditional credit evaluation, Bright also checks your bank accounts and credit cards to get a deeper insight into your financial situation. These insights play an important role in determining the terms of your credit, including both your credit limit and interest rate if you qualify. Credit limits range from $500 to $8,000, with corresponding interest rates ranging from 9% to 24.99%.

Once you have access, Bright Credit empowers you to pay off multiple credit cards at once, with the goal of lowering your overall interest rates and saving you money. After this, you will be required to make monthly payments equal to at least 3% of your outstanding balance.

For those considering Bright Credit, evaluating your potential rate and credit limit is a straightforward process via the website or mobile app, and only involves a soft credit check. It’s important to note that accepting an offer may trigger hard inquiries, which could affect your credit score.

Discover the possibilities with Bright Credit – a versatile financial tool designed to ease the burden of high-interest debt and streamline your path to financial freedom.

Check Also: Rewards Giant

How Much Does Bright Money Cost?

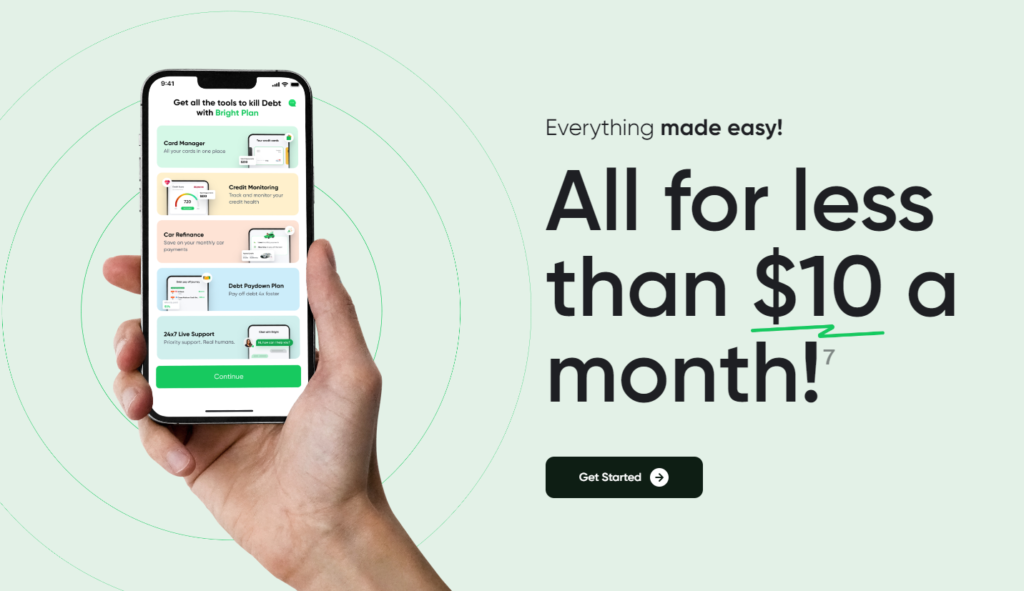

Enrollment in Bright Money is apparently cost-free, its expenses are entirely dependent on the company’s products. However, in reality, Bright appears to be incentivizing users to subscribe to the Bright plan, charging a recurring fee.

Fees vary depending on the payment frequency you choose. Options include $7.42 per month (billed annually at $89), $8.99 per month (billed semi-annually at $53.94), or $9.99 (billed monthly or every three months at $30).

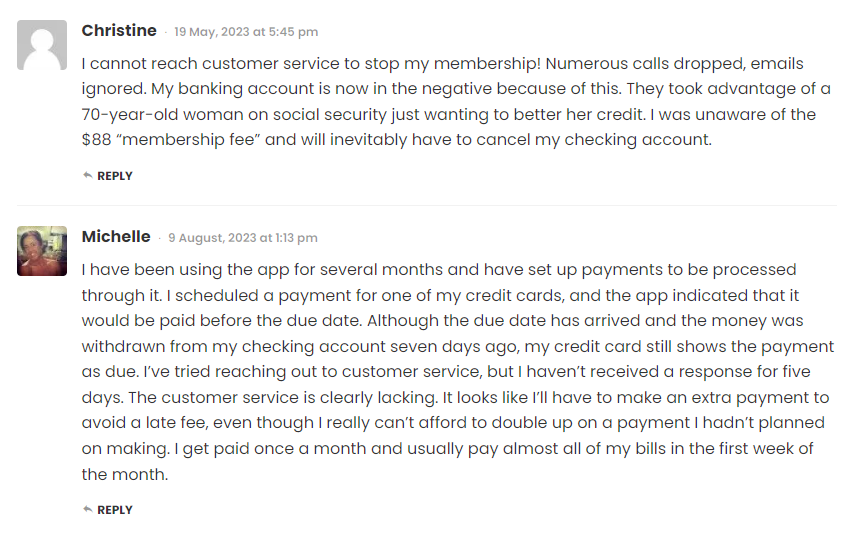

Bright’s transparency is diminished by failing to clearly mention automatic enrollment in this product. Users often discover unexpected charges in their bank statements, requiring complex refund processes. Use caution when experimenting with the app.

Fortunately, accessing Bright’s additional features requires a formal application. This greatly reduces the possibility of inadvertent sign-ups and unexpected charges.

On a positive note, both other products are remarkably budget-friendly. For example, Bright Builder comes with no fees or interest, making it completely free.

Concurrently, the only associated cost with Bright Credit is interest on the outstanding balance, which ranges from 9% to 24.99% annually. Specifically, no application, origination, prepayment, late or annual fees apply.

How Bright Helps You Increase Your Savings

The app provides a tailored Bright Plan, a comprehensive financial strategy that outlines each goal Bright will help you achieve, as well as associated timelines.

If you’re familiar with Dave Ramsey’s Baby Steps, you’ll recognize the approach Bright takes here. It focuses on tackling one goal at a time, with a primary focus on setting up a modest emergency fund and settling high-interest debts.

In my tests, Bright suggested the following goals, in the specified order:

Give priority to settling the credit cards with the highest interest.

Establish an emergency fund of $1,000.

- Settle remaining credit card balances.

- Save for upcoming short-term purposes like vacations, tuition or weddings.

- Start an investment plan with 5% of your monthly income.

- Aspire to achieve a specific goal.

Although this order may be subject to individual circumstances, such as having a 401(k) match, some may argue that maximizing the match should be prioritized over saving for short-term goals.

For those struggling with high-interest credit card debts, creating a personalized financial plan can potentially accelerate the achievement of your financial objectives.

Regarding target wealth (sixth item in the list above), Bright, during onboarding, inquires about your desired net worth. It then tries to guide you towards an optimal savings rate to achieve that particular financial goal.

Bright Vs. Tally

Adopting a more assertive strategy than Bright, Tally emerges as a valuable application for individuals seeking effective solutions to eliminate credit card debt.

Tally offers a personalized credit line, with a lower interest rate than your existing loan, which it uses to settle your high-interest debts. It is your responsibility to repay this personal credit line to Tally. To be eligible for this credit line, a minimum credit score of 660 is required.

Unlike other financial instruments, Tally’s primary focus is not on growing your savings or achieving diverse financial objectives. Its specific purpose is to help you free yourself from the burden of credit card debt.

Bright Vs. Savology

While Tally focuses specifically on clearing credit card debt, Saveology shares similarities with Bright by offering a tailored financial plan.

Still, as a financial planning tool, I believe Saveology surpasses Bright, primarily because of the comprehensive nature of financial planning it offers.

Unlike Bright, Saveology provides a detailed, step-by-step guide on what aspects to prioritize next, taking into account a wide range of inputs like retirement balances, insurance coverage, and your estate plan.

If you’ve moved past the phase of paying off credit card debt and want personalized financial guidance, dive into our Saveology review for more details.

Is Bright Money Legit?

Bright Money, established in 2019 by a diverse team of experts, stands as a reputed enterprise in the financial sector. After receiving substantial support from investors, the company successfully secured $31 million in its Series A round, thereby strengthening its position in the market.

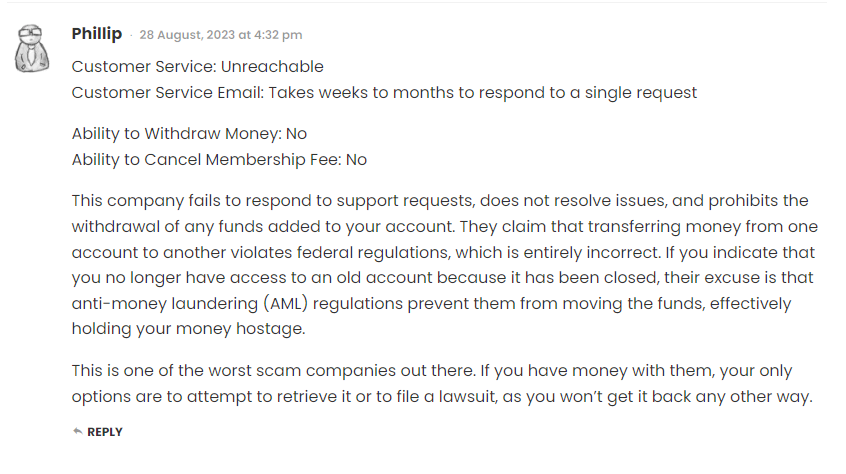

Having served innumerable customers, Bright Money has earned an impressive rating of 4.8 out of 5 stars on the App Store based on 84,000 reviews, and a commendable rating of 4.6 out of 5 stars on Google Play with 39,500 ratings . Despite these high ratings, customer reviews consistently highlight some concerns.

Common complaints revolve around technical hiccups, particularly regarding the unreliability of the app’s plaid connection feature. Additionally, the theme of dissatisfaction with less-transparent billing practices mentioned in previous reviews comes up repeatedly.

In the world of personal finance, Bright Money’s journey has been marked by success, yet it is important to address and improve upon these customer concerns for continued excellence.

Check Also: HoneyGain Review

Bright Money App (Summary)

For individuals struggling with credit card debt and unsure about the optimal approach to settling it, Bright emerges as a valuable resource. Dealing with the complexities of loan repayment can be challenging, especially when considering the commitment and cost associated with seeking professional financial advice.

In such circumstances, Bright presents itself as a viable option. It employs a highly effective financial strategy – paying yourself first – and streamlines the entire process through automation. This approach has earned Bright recognition as one of the leading loan-payoff applications available.

However, Bright may not be as beneficial for individuals who have successfully managed to avoid high-interest debt and have moved into the investment field. In particular, Bright lacks guidance or inquiries related to tax-advantaged accounts like 401(k) or IRAs. These accounts play a vital role in optimizing investment returns, and the absence of such features may limit the usefulness of the app for this particular user demographic.

We are a team of seasoned entrepreneurs, industry experts, and business enthusiasts dedicated to sharing our collective wisdom and experiences. With diverse backgrounds spanning various sectors, we bring a wealth of knowledge to the table, ensuring that our content is not only insightful but also practical and applicable to the real challenges startups face.